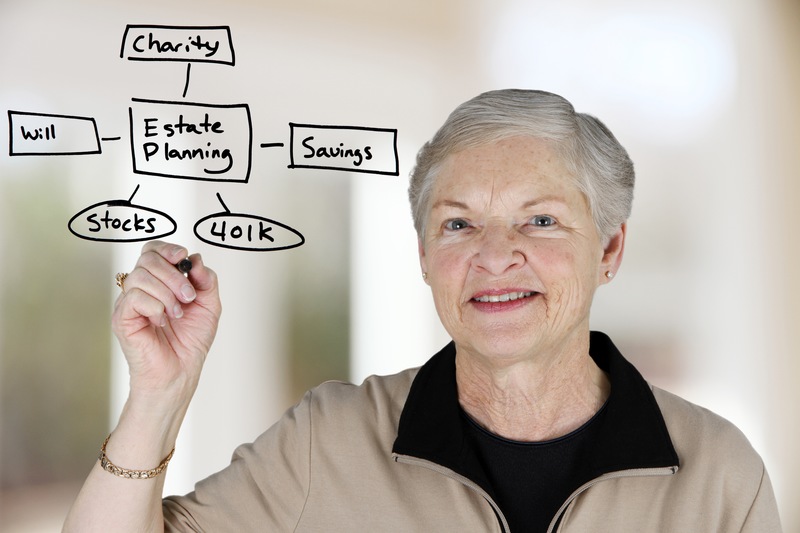

Why Charity Counts During the Estate Planning Process

Whether you’ve devoted your life to an institution, or simply want to leave a powerful legacy where it counts, you may have considered charitable donations as part of your estate planning process. If so, know that there are plenty of ways for you to give back!

In today’s blog, we will be discussing the long-lasting benefits of this kind of giving (even beyond the tax deductions!).

A chance to leave a legacy

Estate planning is a difficult topic to approach, often times because it forces us to think about the legacies we’re set to leave behind. It’s only natural to want to leave a profound impact on your family and surroundings on a local and larger-scale level—but knowing how to do that isn’t always clear. Fortunately, charitable giving through your estate plan lets you leave a legacy with ease. Whether you choose to help your favorite charity, alma mater or another worthwhile institution, your gift will be felt long after your own life.

The achievement of a lifelong goal

Your life’s work is never done—but putting part of your estate toward a worthy cause lets you achieve your goals in a new way. You can count on this kind of donation to further the projects or causes you spent your life working toward—which is not something everyone gets to say!

While many of the details of estate planning can be difficult to manage, the decision to further your life’s work through charity is not one of them.

Family opportunities

Charitable giving in your estate plan also lets you provide for your family in a unique way. Your gift can guide them toward a cause you want them to pursue, or leave room for them to continue your legacy in a way you care deeply about.

Now that you’ve seen the benefits of charitable giving as part of your estate plan, what’s next? If you want to include this kind of giving in your own plan, call our office today to find out how.

Bookmark & Share

User Comments

Be the first to comment on this post below!

Previous Article

Most Popular Articles

- Estate Planning with Your Family

- When Should You Consider Writing a Will?

- Top 5 Reasons Why Estate Plans are Essential

- How Guardianship Protects Minor Children

- How to Settle Will Disputes

- Understanding Your Role as an Estate Personal Representative

- Disaster Preparation and Your Estate Plan

- Benefits of Getting Wills Notarized